What Is Medicare Tax Rate 2025. Unlike the social security tax, medicare tax has no. The social security tax rate remains at 6.2 percent.

Medicare’s trustees estimate that the standard part b premium for 2025 will increase at nearly double the rate of the cola, she said. Find out about medicare levy exemptions for medical.

The budget proposes to increase the medicare tax rate on earned and unearned income above $400,000 from 3.8 percent to 5 percent.

This is the amount you’ll see come out of your paycheck, and it’s matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

Medicare Premiums 2025 Based On Ashli Camilla, Unlike the social security tax, medicare tax has no. Irmaa is a surcharge that people with income above a certain amount must pay in addition to their medicare part b and part d.

Medicare Employee Tax Rate 2025 Lani Shanta, In 2025, the medicare tax rate is 2.9%, split evenly between employers and employees. For the 2025 tax year, those levels are:

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec.png)

2025 Medicare High Surcharge Glori Kalindi, Your 2025 irmaa fees will be based on your 2025 income. What are the irmaa brackets for 2025 and 2025?

Medicare And Ssn Tax Rate 2025 everthought, The 2025 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2025. The irmaa income brackets for 2025 start at.

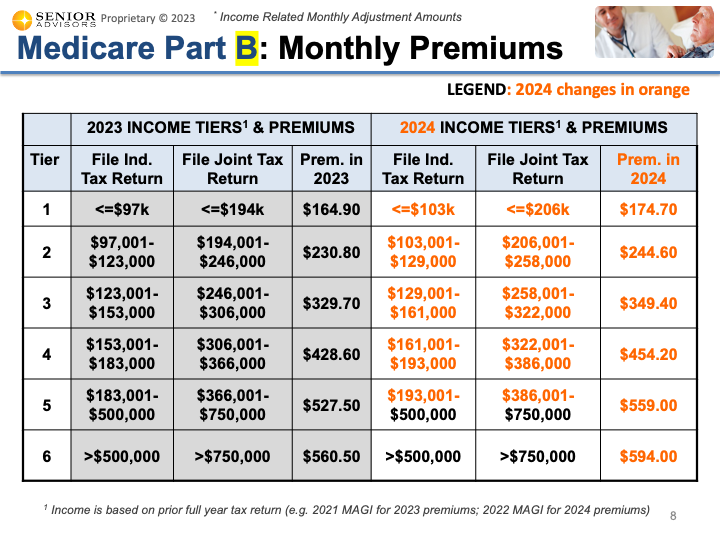

Medicare Tax Wage Limit 2025 Mandy Rozelle, Strategy highlights recent reforms to close loopholes exploited by illicit actors; The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2025.

2025 Tax Brackets Aarp Medicare Heda Rachel, The annual deductible for all. Your 2025 irmaa fees will be based on your 2025 income.

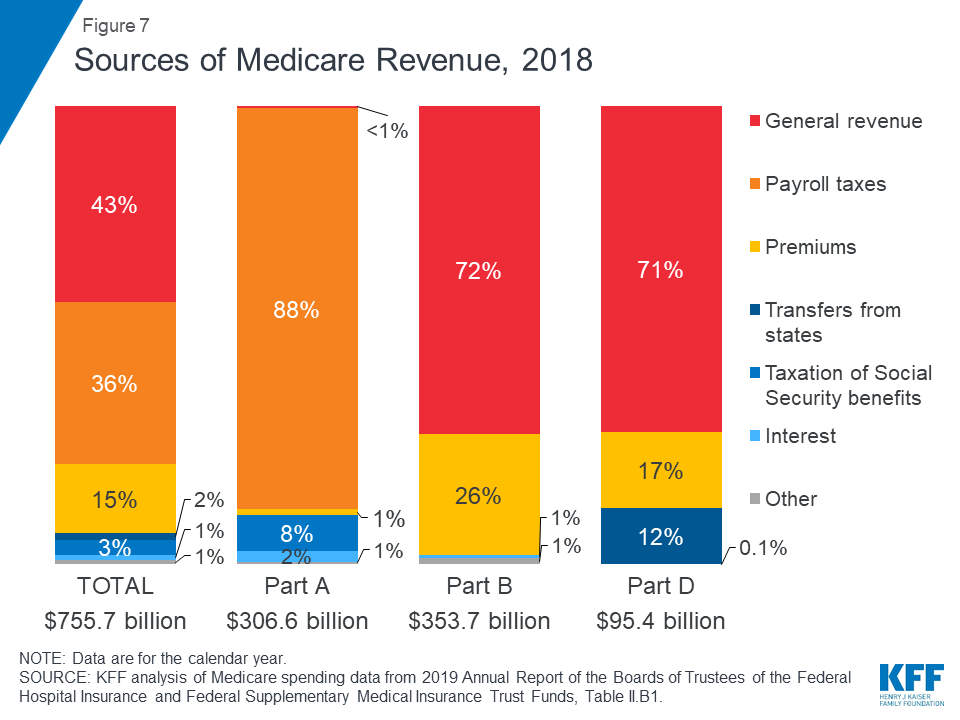

The Facts on Medicare Spending and Financing KFF, This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf. The social security wage base limit is.

How To Account For Medicare Premiums On 1040 Tax, Cbo projects that between 2025 and 2032, net medicare spending—after subtracting premiums and other offsetting receipts—will grow as a share of both the. The social security wage base limit is.

If I Pay Medicare Tax Do I Have Medicare, Cbo projects that between 2025 and 2032, net medicare spending—after subtracting premiums and other offsetting receipts—will grow as a share of both the. The medicare tax rate for 2025 and 2025 is 2.9% and is split between employees and their employer, with each paying 1.45%.

Medicare Tax What is It and What Does It Do?, In 2025, only the first $168,600 of your earnings are subject to the social security tax. The budget proposes to increase the medicare tax rate on earned and unearned income above $400,000 from 3.8 percent to 5 percent.