Illinois Tax Deductions 2025. Use the illinois paycheck calculator to get a clear picture of your net income. Illinois has a flat income tax of 4.95% — all earnings are taxed at the same rate,.

Specifically, illinois imposed a strict $100,000 cap on nol deductions in tax years ending on or after december 31, 2025, and before december 31, 2025. The illinois state tax calculator is updated to include:

W 4 Form 2025 Illinois Colly Rozina, To opt for a standard deduction, or to itemize on your tax return? Choose tax regime wisely for tds, consider basic exemption limits, utilize tax rebates, deductions, and exemptions.

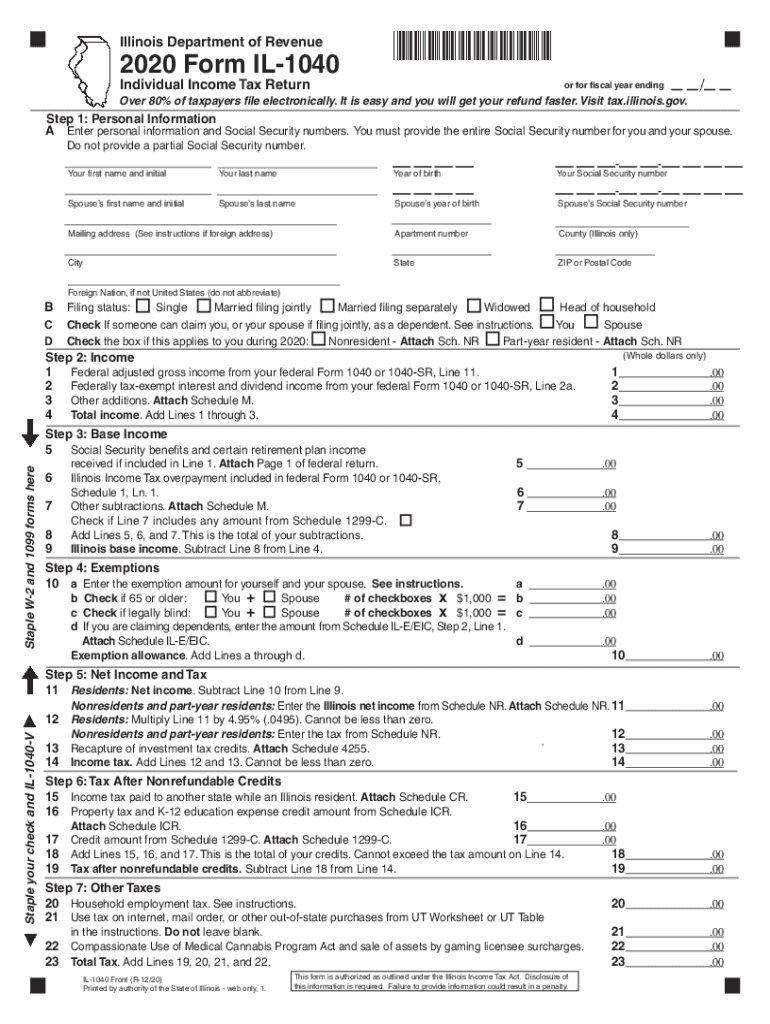

Illinois 1040 20172024 Form Fill Out and Sign Printable PDF Template, As the 2025 tax filing season. Only 10 states do or will continue to tax social security benefits in 2025.

Illinois state tax Fill out & sign online DocHub, Only 10 states do or will continue to tax social security benefits in 2025. Particularly significant are the changes to the tax.

Il W 4 2025 2025 W4 Form, Only 10 states do or will continue to tax social security benefits in 2025. Tax school blog / new 2025 tax rates and thresholds.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Single people are allowed to contribute up to $7,000 for 2025 to a traditional ira. Federal married (joint) filer tax tables.

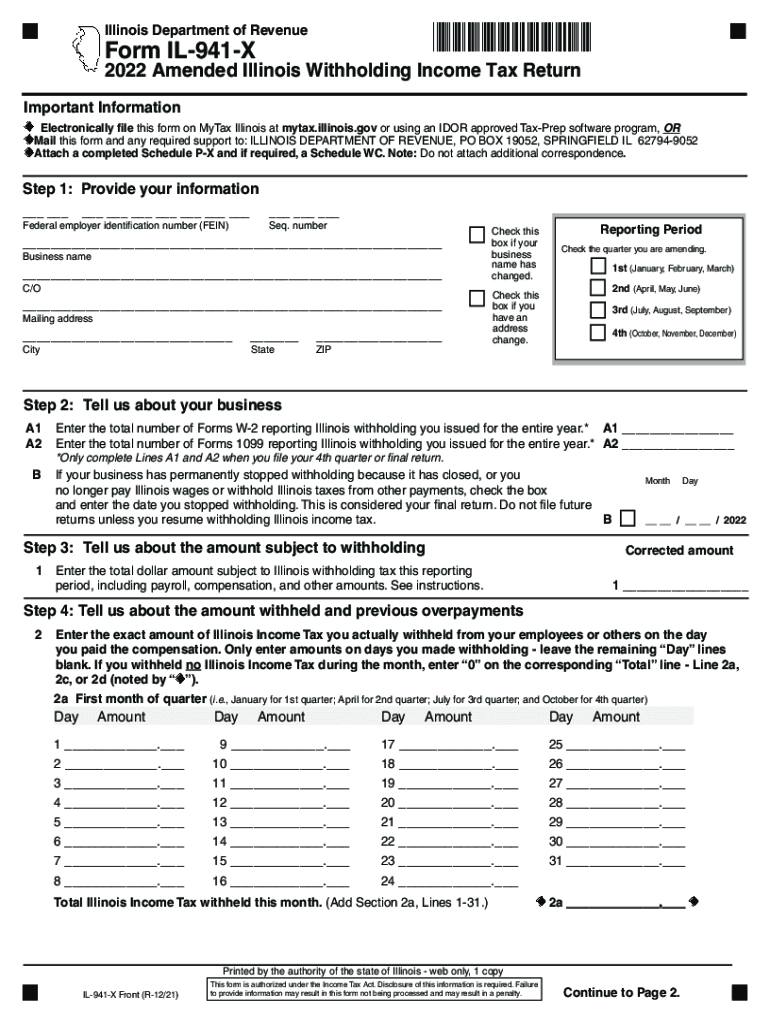

Illinois Dept of Revenue Tax S 20202024 Form Fill Out and Sign, 2025 withholding income tax payment and return due dates. Personal exemption — the personal exemption amount for tax year 2025 will increase to $2,775.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, (a) state taxes capital gains income at a set percentage of the rate that applies to ordinary. The illinois state tax calculator is updated to include:

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, As the 2025 tax filing season. Particularly significant are the changes to the tax.

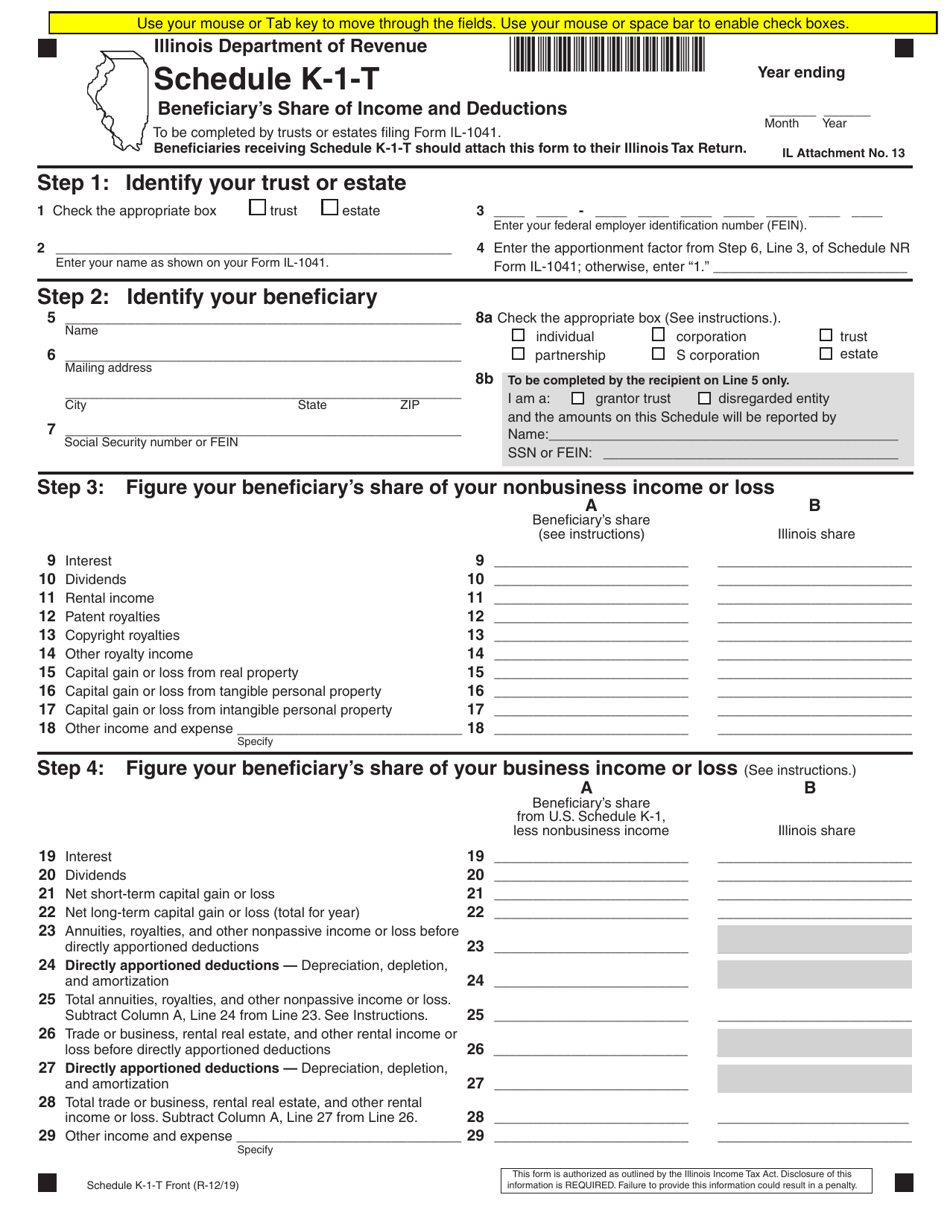

Illinois Beneficiary's Share of and Deductions Fill Out, Sign, If your income qualifies, you can deduct that entire $7,000. Personal exemption — the personal exemption amount for tax year 2025 will increase to $2,775.

Tax illinois Fill out & sign online DocHub, Choose tax regime wisely for tds, consider basic exemption limits, utilize tax rebates, deductions, and exemptions. Updated for 2025 tax year on apr 1, 2025.

Deduct the amount of tax paid from the tax calculation to provide an example of your 2025/25 tax refund.